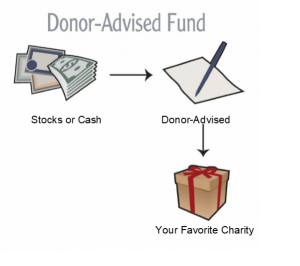

Establishing a Donor Advised Fund allows you to make a gift to your community foundation, then remain actively involved in suggesting uses for your gift. When you make a gift to us, we take your tax deductible contribution and establish a special account in your name. Your account is then invested to grow over time, permitting you to recommend annual gift to your favor charitable organizations. You can work with the community foundation’s professional program staff to suggest ongoing uses for the fund-targeting the issues you care about most. Grant awards are issued to charities in the name of the fund (or anonymously if you prefer). It’s a simple, powerful, and highly personal approach to giving.

A Flexible, Low Cost Alternative to a Private Foundation

A Donor Advised Fund (DAF) offers you a flexible and easy to establish vehicle for charitable giving. Unlike private foundation gifts, DAF gifts generally qualify for a full fair market value charitable deduction and DAF with no startup costs. A DAF also permits you to make grants to charities without the unfavorable Private Foundation restriction and excise taxes.

Recommending Grants

Once your DAF is established you are ready to begin giving! Simply contact us in writing, with your recommendation of how your funding should be distributed. We seek to honor your wishes to help further the organizations and causes you love!

Resources

- Request a Grant From Your Donor Advised Fund

- Donor Advised Fund Guidelines

- Need ideas – GBCF’s Wish List page has needs from area organizations